Spring is almost here, and the National Association of Home Builders Housing Market Index (NAHB HMI) thawed slightly in March.

Haunting Numbers – What if Ghosts of the Past Return?

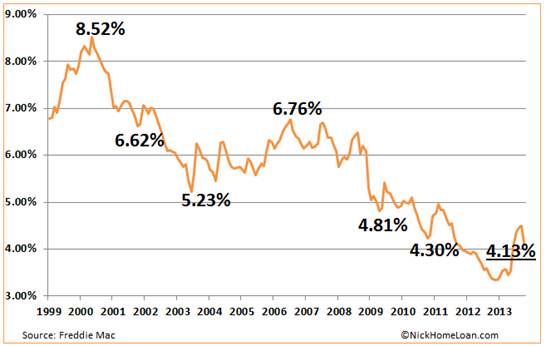

The following is a guest post from Nick Pakulla, a loan officer with Talmer Bancorp, Inc. at First Place Bank: With mortgage rates still near all-time lows and predictions that rates will continue edging up in 2014 and beyond, there are significant long-term interest savings for anyone in the market now! There are no tricks hidden in the […]

Your Home List Price, Should You Lower It?

Are you trying to sell your home and finding that it is not selling very well? This might be due to a number of reasons that you can’t control, such as its location or the fact that the home layout is somewhat unusual. If you are struggling to sell your home, there is one factor that you can alter that might change things â the price.

Many homeowners are reluctant to lower the price of their home, because it feels somewhat like a defeat. However, while you want to make as much money from your house sale as possible â it is better to sell your home at a slightly cheaper price than to let it sit on the market for a long time.

4 Quick Tips On Becoming A Young Real Estate Investor

Investing in property at a young age seems like a bit of a daunting prospect sometimes. Most young people don’t have a lot of disposable income, often have poor credit and perhaps even student loans.

What’s Ahead For Mortgage Rates This Week – September 9, 2013

Last week was relatively calm due to the Labor Day Holiday on Monday little mortgage and housing related news. However, there were several positive indicators for overall economic conditions.

Case-Shiller Index Verifies Home Value Gains Through Q3 2012

According to the S&P/Case-Shiller Index, which was released earlier this week, U.S. home prices rose in September for the sixth straight month, climbing 0.3% as compared to the month prior.